Homeowner Resources

Whether you just bought your first home or are a longtime homeowner, we can provide tips, tools, and insights to help you make informed decisions.

Settle in

Settle in

There are a few things you can do right away to avoid future problems and make your home safer.

Your mortgage statement

We can help explain the numbers, acronyms, and technical terms on your monthly mortgage statement.

Why did I receive a loan purchase letter?

Fannie Mae purchases mortgages from lenders to keep money flowing in the housing market. Learn more about what it means if Fannie Mae purchased your mortgage.

Create an emergency action plan

You’ve moved in! Now make sure you’re prepared to keep everyone in your household safe in case of an emergency.

What to know about Homeowners Associations

Homeowners associations come with benefits and rules. See what you can expect from your HOA.

Get the most out of your home inspection report

Your inspection report may be the closest thing you have to a custom homeowner’s manual — use it to get to know your home.

Upgrade and improve

Upgrade and improve

Once you’re settled, consider big and small ways you can make your home more comfortable and save on costs down the road.

Save on energy costs

Energy smart appliances and systems can be good for your wallet and make your home more comfortable.

Energy efficiency upgrades to consider

Want to get a handle on your energy costs? Consider these upgrades that can help lower costs and improve the comfort of your home.

Protect and maintain

Protect and maintain

You can’t prevent an unexpected disaster or emergency from affecting your home, but you can prepare ahead of time to reduce its impact.

Prepare for severe weather

It’s hard to predict where or when severe weather will occur. Prepare for it with our practical household tips to help weather the storm.

Install and test smoke detectors

Working smoke detectors save lives, and in most cases, they’re required by law. Get tips for installing, testing, and maintaining the smoke alarms in your home.

Top 12 fire safety and prevention tips

Protect your loved ones and your home with these fire safety and prevention tips.

Insurance coverage guide

Knowledge is power: Make sure you know what is and isn’t covered by your home insurance.

Manage home finances

Manage home finances

Small steps can get you on the path to financial security. Here are some resources to help keep you moving toward your goals.

Save for an emergency fund

Learn 3 strategies for building an emergency savings fund to help you manage life’s unexpected costs.

Create a debt action plan

Managing debt can feel overwhelming. Compare debt management methods to help you stay ahead of your debt repayments.

Build a maintenance and repair budget

Creating a realistic budget can help you take control of your finances. There’s no one way to budget, so see what can work for you and your circumstances.

Manage your credit

Learn how to monitor and manage your credit so you can maintain maximum financial flexibility.

New Home, Now What?

Sign up to receive new homeowner tips straight to your inbox. Our monthly email digest contains useful resources to help you prioritize taking care of your new home and finances.

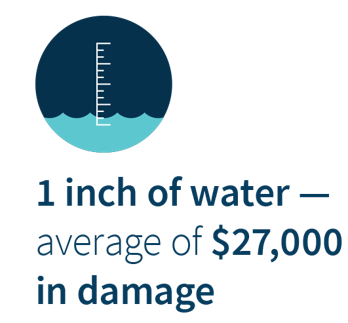

Know your home’s flood risk

Flood threats are increasing every year. Your home may be one of your biggest investments, so it's important to understand potential flood-related risks and be prepared.

No matter where you live, risk of flood exists. Learn how to look up your home’s flood risk and insurance options to make informed decisions that can protect your financial well-being.

Should you refinance?

While refinancing your mortgage can offer potential benefits, there are also costs to consider. Weigh the costs and benefits of refinancing here.

Learn more

Refinancing options

Fannie Mae offers several refinance products you can discuss with your lender. Each one is tailored to meet unique needs.

Learn moreFinancial help available when homeowners need it

The home-selling process

When you take the process step by step, selling your home can be easier to manage.

1

Step 1–Get started

There are a few things you need to do before you put your home on the market — from reviewing your equity and current market conditions to preparing your home to show to potential buyers.

2

Step 2–List your home

When your home is ready to sell, you can work with a real estate agent to develop a marketing plan and start attracting buyers with open houses, in-person showings, and virtual tours.

3

Step 3–Sell your home

Once you get an offer — or maybe several — you’ll agree on terms with a buyer, finalize the contract, and close the sale.