Why Understanding Debt Is Essential

There are many steps prospective homeowners must take before beginning the homebuying process. Being able to calculate your debt-to-income ratio (DTI) is helpful because it can help you determine how taking on new debt will impact how you manage your expenses. It’s also an important factor lenders use to determine your eligibility for a mortgage.

If you’re looking to buy or refinance a home, it’s important to understand your debt-to-income ratio (DTI). If you’re not familiar with a DTI, it’s the amount of debt you have compared to your income. It is a percentage that weighs how much you owe in debt like rent, credit cards, or auto loans each month against your total monthly gross income.

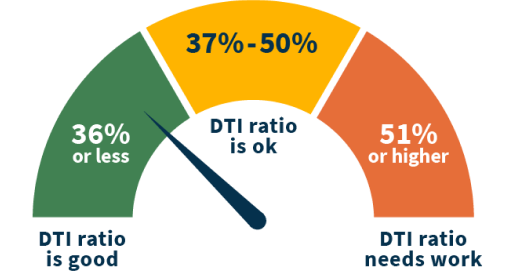

Lenders see this figure as a key indicator of how well your money is managed and use it to determine whether you can afford to take on the debt of a new mortgage. A lower DTI ratio is typically a positive indicator that you’ll be able to afford your mortgage. If your DTI ratio is too high that could signal that you may be unable to take on more debt such as a mortgage.

Calculate your debt-to-income ratio

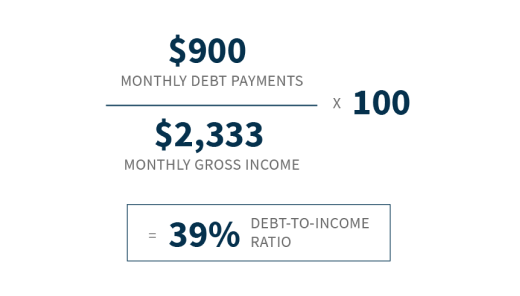

You can calculate your DTI manually — just add up your total monthly debt payments, and then divide that amount by your gross monthly income (the total monthly income before taxes have been deducted). Monthly debt payments may include housing payments, any student loans or car loans, alimony or child support, minimum credit card payments, etc. When calculating your DTI, monthly debt will not include monthly payments such as utilities, cell phone, or internet payments.

So, for example, if every month your total monthly debt payments are $900, you make $28,000 a year, and your gross monthly income is $2,333 — you would divide $900 by $2,333, which comes out to 0.39. Then multiply this by 100 to get your current DTI ratio of 39%.

There are many factors lenders consider when reviewing home loan applications. Your DTI will play a large role in determining the amount you’ll be approved to borrow, your interest rate, and other loan terms.

A DTI of 36% or less is considered good. If your DTI is above 50%, you’ll most likely need to work on lowering it before applying for a mortgage.

Are you looking to buy a home but worried your debt-to-income ratio is too high? Here are a few techniques that can help you maintain or lower your DTI before applying.

- Review your budget for extra money that could be used for paying off debt.

- Review your current credit report for an overview of all debts and the payments associated with them.

- Avoid large purchases, especially if they add to your debt.

- Nothing happens overnight. Give yourself as much time as you need to pay your debt down.